- Small Business Owners: Automate daily bookkeeping without hassle.

- Multi-Entity Operators: Track finances across companies seamlessly.

- Freelancers: Catch deductions like travel and home office easily.

- CPAs & Accountants: Speed reviews with AI pre-categorization.

- Growing Startups: Gain vendor insights to cut unnecessary costs.

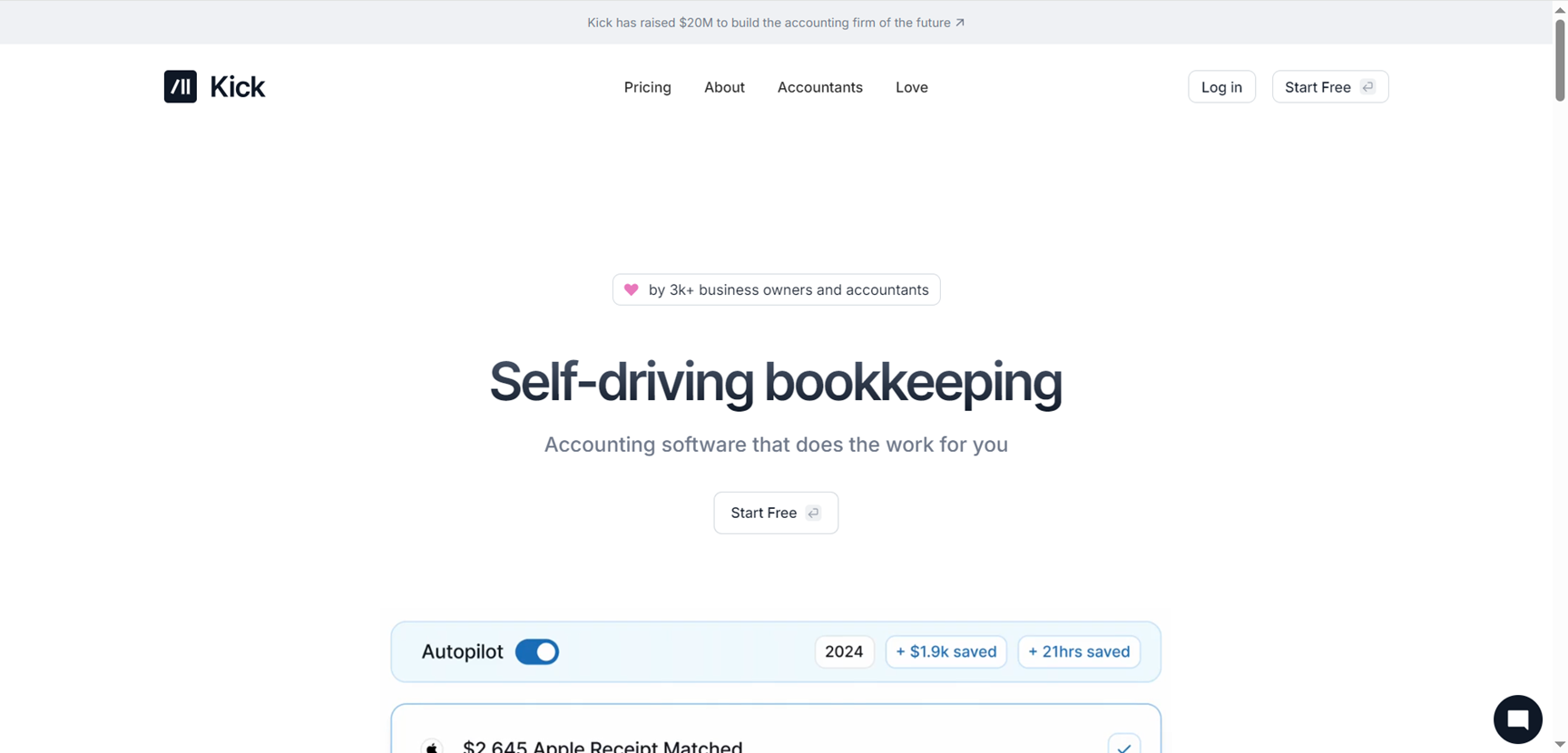

How to Use Kick?

- Connect Accounts: Link banks and set up in minutes.

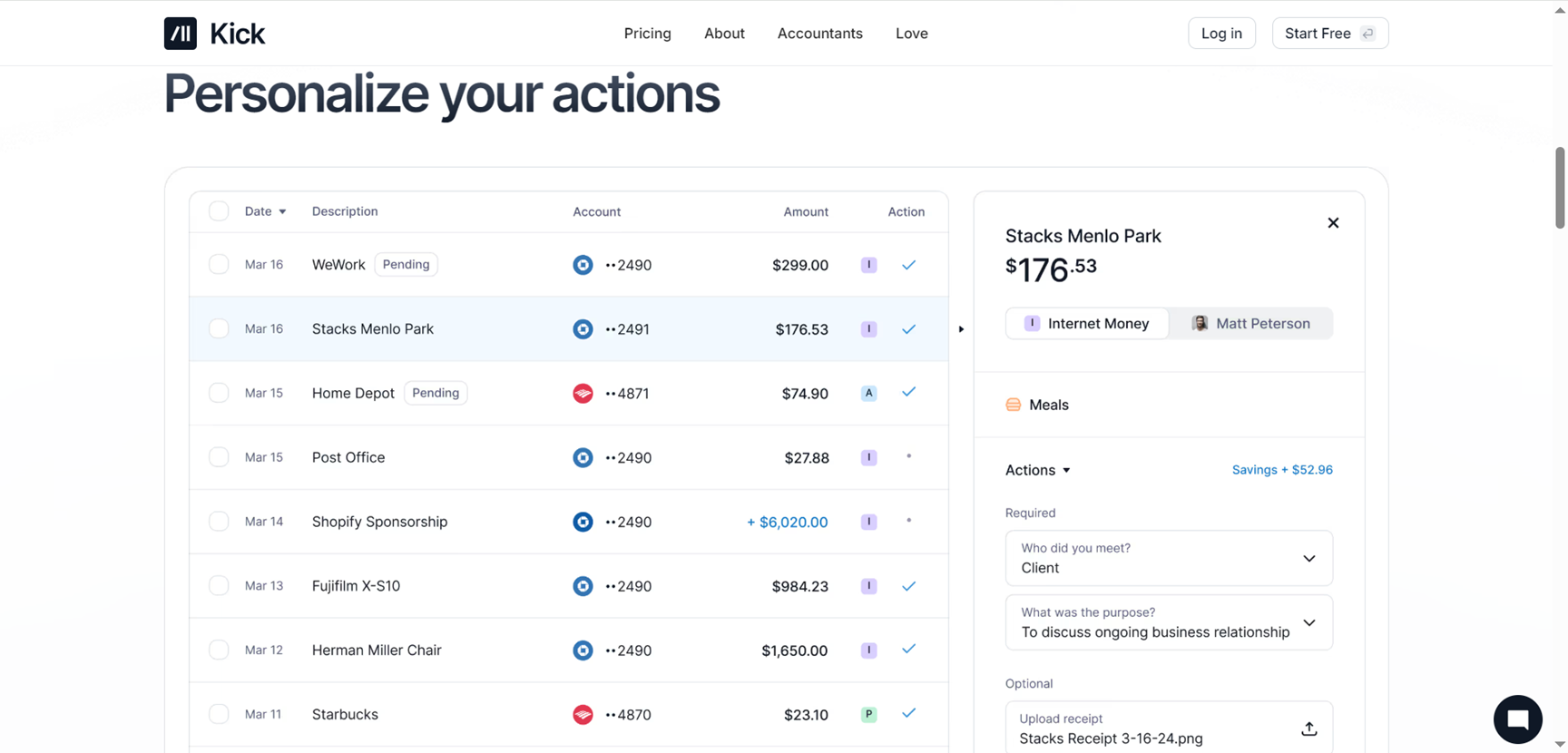

- Review Auto-Categorizations: Adapt AI rules with expert oversight.

- Track Deductions & Revenue: Let it flag savings and custom lines.

- Generate Reports: Download P&L, balance sheets, or journal entries.

- AI + Human Review: Real-time categorization verified by experts.

- Deduction Hunter: Auto-finds home office, vehicle, travel misses.

- Multi-Entity Magic: Handles intercompany without extra fees.

- Custom Revenue Lines: Shows income sources monthly clearly.

- Vendor Expense Breakdowns: Cuts waste with actionable insights.

- Saves hours on categorization and tax prep.

- Expert review ensures bulletproof accuracy.

- Multi-business support without complexity.

- Testimonials prove real money saved fast.

- Best for US tax deductions mainly.

- Setup needs account connections first.

- Journal entries powerful but advanced.

- No free tier mentioned for trials.

Free

$ 0.00

Auto categorization

Receipt matching

Basic integrations

And more...

Basic

$ 35.00

Custom categories

Importer

Rules

Gusto integration

And more...

Plus

$ 125.00

Balance sheet

Custom chart of accounts

Multiple entities

Classes

And more...

Custom

Contact Sales

Live onboarding

Dedicated support

Annual close

Partner services

And more...

Proud of the love you're getting? Show off your AI Toolbook reviews—then invite more fans to share the love and build your credibility.

Add an AI Toolbook badge to your site—an easy way to drive followers, showcase updates, and collect reviews. It's like a mini 24/7 billboard for your AI.

Reviews

Rating Distribution

Average score

Popular Mention

FAQs

Similar AI Tools

Dot

Dot AI is an advanced AI-powered data assistant that enables teams to obtain instant, actionable insights from their data. By integrating seamlessly with existing analytics infrastructure, Dot allows users to ask data-related questions in natural language and receive accurate, context-aware answers in real-time.

Dot

Dot AI is an advanced AI-powered data assistant that enables teams to obtain instant, actionable insights from their data. By integrating seamlessly with existing analytics infrastructure, Dot allows users to ask data-related questions in natural language and receive accurate, context-aware answers in real-time.

Dot

Dot AI is an advanced AI-powered data assistant that enables teams to obtain instant, actionable insights from their data. By integrating seamlessly with existing analytics infrastructure, Dot allows users to ask data-related questions in natural language and receive accurate, context-aware answers in real-time.

HeronAI

HeronAI is an AI-powered analytics platform designed to simplify financial reporting and transform raw data into actionable insights. It enables businesses to generate real-time dashboards and reports in minutes, eliminating the need for manual data analysis and empowering teams to make informed decisions swiftly.

HeronAI

HeronAI is an AI-powered analytics platform designed to simplify financial reporting and transform raw data into actionable insights. It enables businesses to generate real-time dashboards and reports in minutes, eliminating the need for manual data analysis and empowering teams to make informed decisions swiftly.

HeronAI

HeronAI is an AI-powered analytics platform designed to simplify financial reporting and transform raw data into actionable insights. It enables businesses to generate real-time dashboards and reports in minutes, eliminating the need for manual data analysis and empowering teams to make informed decisions swiftly.

SREDSimplify

SRED Simplify (often stylized “SRED Simplify”) is a fintech product designed to streamline business accounting and tax processes for freelancers, small businesses, and creators. It aims to simplify expense tracking, invoice management, tax form generation, and financial insights — all in one centralized dashboard. The platform is tailored to reduce the administrative burden of bookkeeping and compliance, especially for those who do not have dedicated accounting teams.

SREDSimplify

SRED Simplify (often stylized “SRED Simplify”) is a fintech product designed to streamline business accounting and tax processes for freelancers, small businesses, and creators. It aims to simplify expense tracking, invoice management, tax form generation, and financial insights — all in one centralized dashboard. The platform is tailored to reduce the administrative burden of bookkeeping and compliance, especially for those who do not have dedicated accounting teams.

SREDSimplify

SRED Simplify (often stylized “SRED Simplify”) is a fintech product designed to streamline business accounting and tax processes for freelancers, small businesses, and creators. It aims to simplify expense tracking, invoice management, tax form generation, and financial insights — all in one centralized dashboard. The platform is tailored to reduce the administrative burden of bookkeeping and compliance, especially for those who do not have dedicated accounting teams.

Vossa

Vossa.app is a smart AI-powered expense tracker designed to make budgeting effortless in just five minutes a day. It combines receipt scanning, voice input, and manual entry to help users manage their finances conveniently without complex setup or syncing hassles. The platform uses intelligent auto-categorization and clean visual stats to keep spending organized while ensuring users stay within budget limits. With Vossa, expense management becomes quick, intuitive, and accessible for anyone wanting a simple yet powerful tool to track spending habits.

Vossa

Vossa.app is a smart AI-powered expense tracker designed to make budgeting effortless in just five minutes a day. It combines receipt scanning, voice input, and manual entry to help users manage their finances conveniently without complex setup or syncing hassles. The platform uses intelligent auto-categorization and clean visual stats to keep spending organized while ensuring users stay within budget limits. With Vossa, expense management becomes quick, intuitive, and accessible for anyone wanting a simple yet powerful tool to track spending habits.

Vossa

Vossa.app is a smart AI-powered expense tracker designed to make budgeting effortless in just five minutes a day. It combines receipt scanning, voice input, and manual entry to help users manage their finances conveniently without complex setup or syncing hassles. The platform uses intelligent auto-categorization and clean visual stats to keep spending organized while ensuring users stay within budget limits. With Vossa, expense management becomes quick, intuitive, and accessible for anyone wanting a simple yet powerful tool to track spending habits.

Attio

Attio is an AI-native CRM platform designed for go-to-market (GTM) teams and business builders who want to execute revenue strategies with precision. It offers a highly flexible data model that adapts to each business’s unique workflows rather than forcing businesses to adapt to the CRM. Attio integrates seamlessly with multiple data sources, including email, calendar, billing, customer support, and product data, creating a unified, real-time source of truth. The platform features powerful automation engines for complex processes, AI-driven research agents for lead prospecting and routing, and advanced reporting tools that generate deep business insights instantly. It is built for scale, handling millions of records with low latency, and follows robust security and compliance standards such as GDPR, CCPA, and ISO certifications.

Attio

Attio is an AI-native CRM platform designed for go-to-market (GTM) teams and business builders who want to execute revenue strategies with precision. It offers a highly flexible data model that adapts to each business’s unique workflows rather than forcing businesses to adapt to the CRM. Attio integrates seamlessly with multiple data sources, including email, calendar, billing, customer support, and product data, creating a unified, real-time source of truth. The platform features powerful automation engines for complex processes, AI-driven research agents for lead prospecting and routing, and advanced reporting tools that generate deep business insights instantly. It is built for scale, handling millions of records with low latency, and follows robust security and compliance standards such as GDPR, CCPA, and ISO certifications.

Attio

Attio is an AI-native CRM platform designed for go-to-market (GTM) teams and business builders who want to execute revenue strategies with precision. It offers a highly flexible data model that adapts to each business’s unique workflows rather than forcing businesses to adapt to the CRM. Attio integrates seamlessly with multiple data sources, including email, calendar, billing, customer support, and product data, creating a unified, real-time source of truth. The platform features powerful automation engines for complex processes, AI-driven research agents for lead prospecting and routing, and advanced reporting tools that generate deep business insights instantly. It is built for scale, handling millions of records with low latency, and follows robust security and compliance standards such as GDPR, CCPA, and ISO certifications.

DualEntry

DualEntry is an AI-native ERP platform designed to replace legacy accounting systems and streamline financial processes for growing enterprises. It offers a fully automated, cloud-based accounting suite that supports multi-entity management with features like auto-eliminating intercompany transactions and consolidation reporting. DualEntry integrates with over 13,000 apps and banking services to unify data and reduce errors, while customizable general ledger classifications and AI-driven automations make financial workflows more efficient. The platform is compliant with major accounting standards like IFRS and GAAP, and meets security certifications such as SOC 2, GDPR, and CCPA. Designed to scale businesses to IPO, DualEntry accelerates month-end close, audit readiness, and treasury management with intelligent automations.

DualEntry

DualEntry is an AI-native ERP platform designed to replace legacy accounting systems and streamline financial processes for growing enterprises. It offers a fully automated, cloud-based accounting suite that supports multi-entity management with features like auto-eliminating intercompany transactions and consolidation reporting. DualEntry integrates with over 13,000 apps and banking services to unify data and reduce errors, while customizable general ledger classifications and AI-driven automations make financial workflows more efficient. The platform is compliant with major accounting standards like IFRS and GAAP, and meets security certifications such as SOC 2, GDPR, and CCPA. Designed to scale businesses to IPO, DualEntry accelerates month-end close, audit readiness, and treasury management with intelligent automations.

DualEntry

DualEntry is an AI-native ERP platform designed to replace legacy accounting systems and streamline financial processes for growing enterprises. It offers a fully automated, cloud-based accounting suite that supports multi-entity management with features like auto-eliminating intercompany transactions and consolidation reporting. DualEntry integrates with over 13,000 apps and banking services to unify data and reduce errors, while customizable general ledger classifications and AI-driven automations make financial workflows more efficient. The platform is compliant with major accounting standards like IFRS and GAAP, and meets security certifications such as SOC 2, GDPR, and CCPA. Designed to scale businesses to IPO, DualEntry accelerates month-end close, audit readiness, and treasury management with intelligent automations.

Alkymi

Alkymi is an AI-powered data automation platform designed specifically for financial services and private markets. It transforms unstructured investment and financial documents, such as capital calls, quarterly reports, financial statements, and offering memorandums, into structured, actionable datasets. The platform uses advanced AI, machine learning, and large language models (LLMs) to automate complex data workflows, enabling firms to unlock and manage 100% of their investment data efficiently. Alkymi’s end-to-end solution integrates with downstream systems, providing real-time portfolio data, accelerating operational workflows, and empowering clients to make faster, data-driven investment decisions. It is tailored to meet the needs of private market firms and helps scale operations with greater accuracy and speed.

Alkymi

Alkymi is an AI-powered data automation platform designed specifically for financial services and private markets. It transforms unstructured investment and financial documents, such as capital calls, quarterly reports, financial statements, and offering memorandums, into structured, actionable datasets. The platform uses advanced AI, machine learning, and large language models (LLMs) to automate complex data workflows, enabling firms to unlock and manage 100% of their investment data efficiently. Alkymi’s end-to-end solution integrates with downstream systems, providing real-time portfolio data, accelerating operational workflows, and empowering clients to make faster, data-driven investment decisions. It is tailored to meet the needs of private market firms and helps scale operations with greater accuracy and speed.

Alkymi

Alkymi is an AI-powered data automation platform designed specifically for financial services and private markets. It transforms unstructured investment and financial documents, such as capital calls, quarterly reports, financial statements, and offering memorandums, into structured, actionable datasets. The platform uses advanced AI, machine learning, and large language models (LLMs) to automate complex data workflows, enabling firms to unlock and manage 100% of their investment data efficiently. Alkymi’s end-to-end solution integrates with downstream systems, providing real-time portfolio data, accelerating operational workflows, and empowering clients to make faster, data-driven investment decisions. It is tailored to meet the needs of private market firms and helps scale operations with greater accuracy and speed.

Fazeshift

Fazeshift is an AI-powered platform deploying specialized agents for accounts receivable automation, integrating seamlessly with existing ERP, CRM, billing, and payment systems like Stripe, NetSuite, Sage Intacct, and SAP. It handles cash application for complex matching scenarios, automated collections with smart reminders, AI contract review comparing terms to billing, billing agent turning contracts into invoices, payment portal for self-serve customer access, credit agent pulling reports and setting limits, payment dispute tracking, and onboarding agent syncing forms to ERPs. The security-first solution eliminates over 90% of manual tasks, unlocks daily productivity hours, accelerates cash flow, provides AI insights, and ensures unified visibility with SOC 2 Type II compliance, GDPR adherence, SSO, and zero-data retention.

Fazeshift

Fazeshift is an AI-powered platform deploying specialized agents for accounts receivable automation, integrating seamlessly with existing ERP, CRM, billing, and payment systems like Stripe, NetSuite, Sage Intacct, and SAP. It handles cash application for complex matching scenarios, automated collections with smart reminders, AI contract review comparing terms to billing, billing agent turning contracts into invoices, payment portal for self-serve customer access, credit agent pulling reports and setting limits, payment dispute tracking, and onboarding agent syncing forms to ERPs. The security-first solution eliminates over 90% of manual tasks, unlocks daily productivity hours, accelerates cash flow, provides AI insights, and ensures unified visibility with SOC 2 Type II compliance, GDPR adherence, SSO, and zero-data retention.

Fazeshift

Fazeshift is an AI-powered platform deploying specialized agents for accounts receivable automation, integrating seamlessly with existing ERP, CRM, billing, and payment systems like Stripe, NetSuite, Sage Intacct, and SAP. It handles cash application for complex matching scenarios, automated collections with smart reminders, AI contract review comparing terms to billing, billing agent turning contracts into invoices, payment portal for self-serve customer access, credit agent pulling reports and setting limits, payment dispute tracking, and onboarding agent syncing forms to ERPs. The security-first solution eliminates over 90% of manual tasks, unlocks daily productivity hours, accelerates cash flow, provides AI insights, and ensures unified visibility with SOC 2 Type II compliance, GDPR adherence, SSO, and zero-data retention.

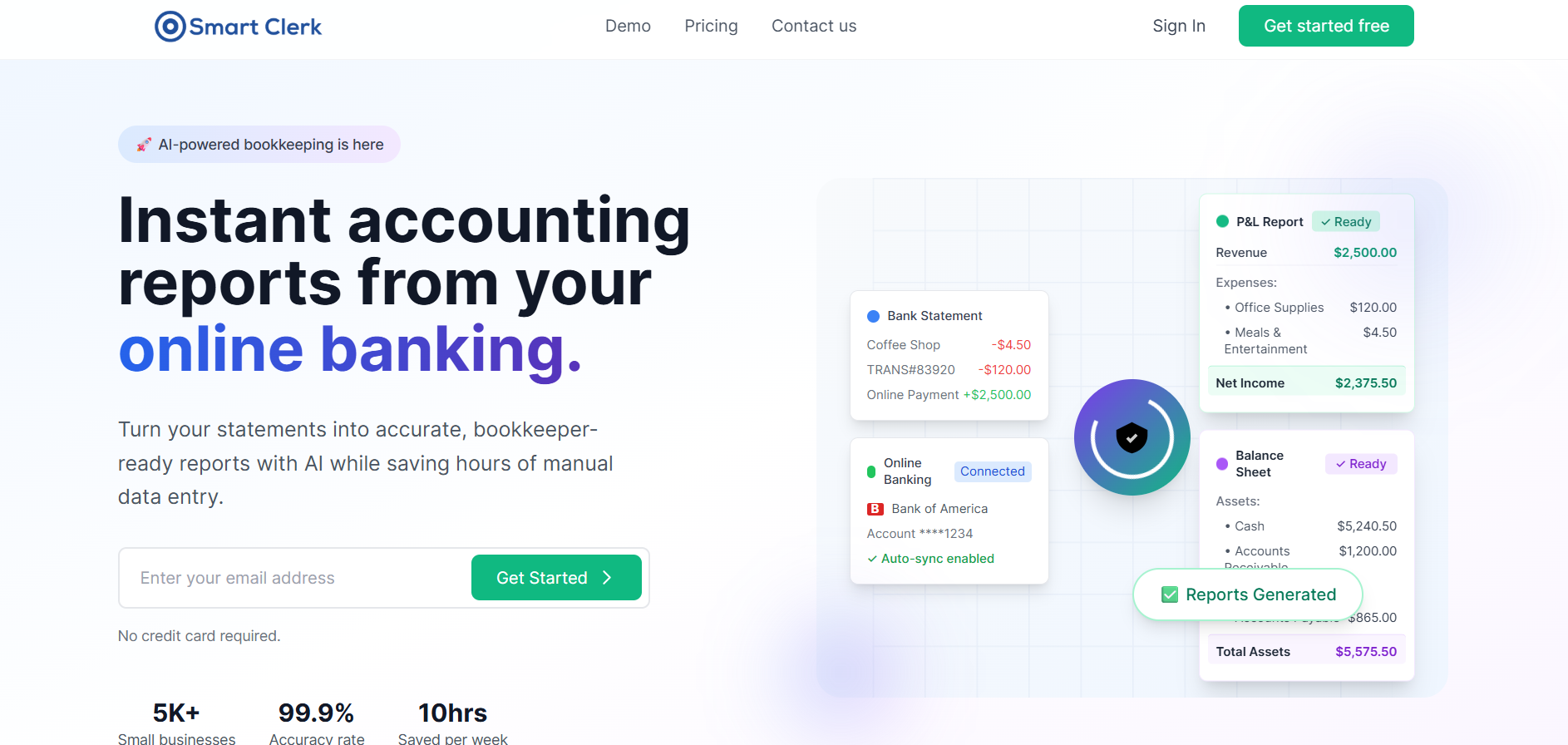

SmartClerk

SmartClerk is an AI-powered accounting automation platform that converts raw financial statements into accurate, bookkeeper-ready reports within minutes. Instead of manually entering transactions from bank statements or spending hours reconciling data, SmartClerk uses intelligent extraction and classification to transform statements into structured financial records. It is designed to reduce accounting friction for businesses, accountants, and finance teams by delivering clean, organized reports that align with standard bookkeeping workflows.

SmartClerk

SmartClerk is an AI-powered accounting automation platform that converts raw financial statements into accurate, bookkeeper-ready reports within minutes. Instead of manually entering transactions from bank statements or spending hours reconciling data, SmartClerk uses intelligent extraction and classification to transform statements into structured financial records. It is designed to reduce accounting friction for businesses, accountants, and finance teams by delivering clean, organized reports that align with standard bookkeeping workflows.

SmartClerk

SmartClerk is an AI-powered accounting automation platform that converts raw financial statements into accurate, bookkeeper-ready reports within minutes. Instead of manually entering transactions from bank statements or spending hours reconciling data, SmartClerk uses intelligent extraction and classification to transform statements into structured financial records. It is designed to reduce accounting friction for businesses, accountants, and finance teams by delivering clean, organized reports that align with standard bookkeeping workflows.

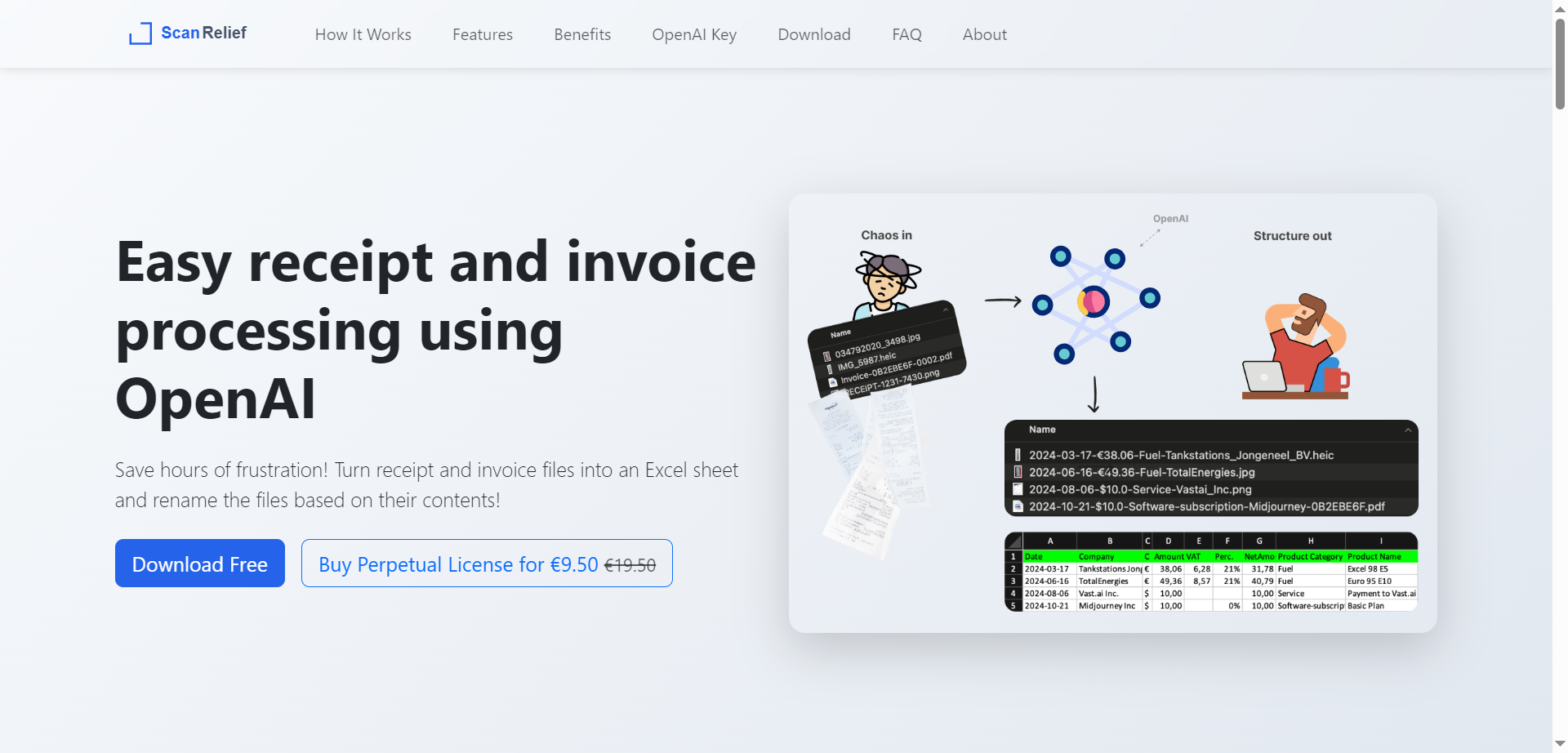

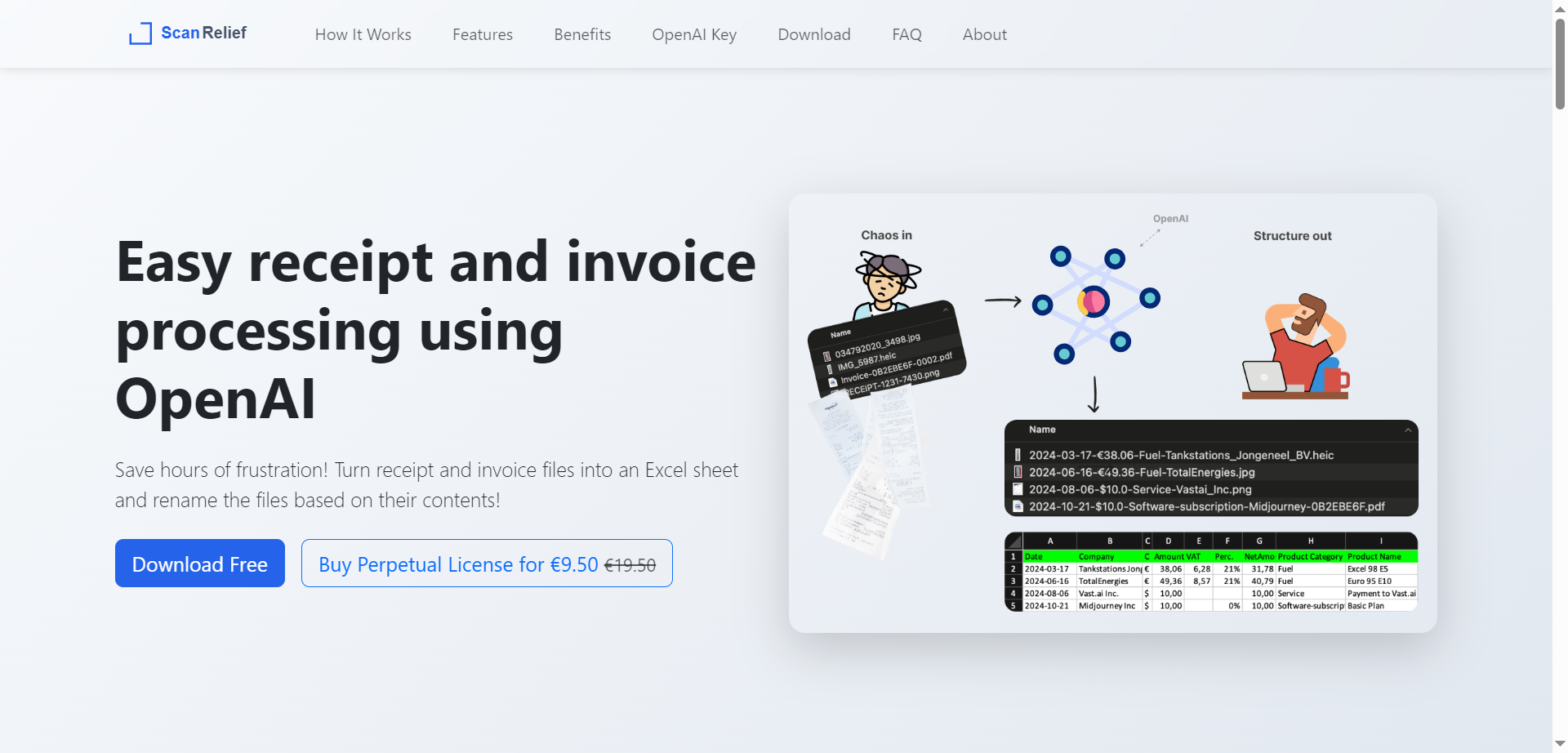

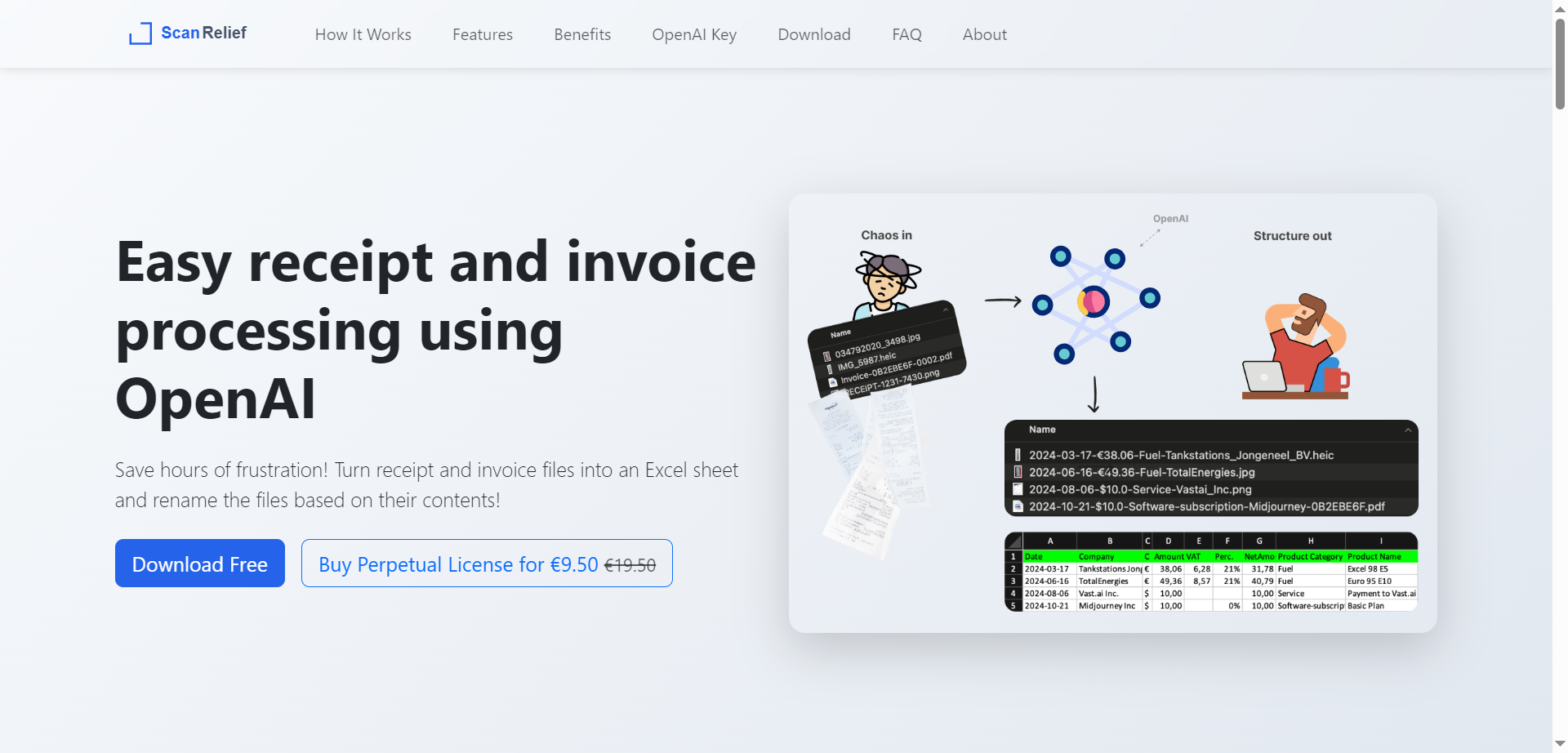

ScanRelief

ScanRelief is a streamlined desktop application that automates receipt and invoice processing by leveraging OpenAI's GPT-4 technology to scan, rename, and organize financial documents on your local computer. Unlike subscription-based cloud services, it operates directly on your Windows or Mac hard drive, ensuring privacy while automatically renaming files based on key details like date, vendor, and amount for chronological sorting. The tool generates a comprehensive Excel spreadsheet containing all extracted data, making tax preparation, expense tracking, and audits effortless. With a transparent pay-per-use model costing approximately 50 cents per 100 receipts through OpenAI, ScanRelief offers long-term value without recurring subscription fees or vendor lock-in.

ScanRelief

ScanRelief is a streamlined desktop application that automates receipt and invoice processing by leveraging OpenAI's GPT-4 technology to scan, rename, and organize financial documents on your local computer. Unlike subscription-based cloud services, it operates directly on your Windows or Mac hard drive, ensuring privacy while automatically renaming files based on key details like date, vendor, and amount for chronological sorting. The tool generates a comprehensive Excel spreadsheet containing all extracted data, making tax preparation, expense tracking, and audits effortless. With a transparent pay-per-use model costing approximately 50 cents per 100 receipts through OpenAI, ScanRelief offers long-term value without recurring subscription fees or vendor lock-in.

ScanRelief

ScanRelief is a streamlined desktop application that automates receipt and invoice processing by leveraging OpenAI's GPT-4 technology to scan, rename, and organize financial documents on your local computer. Unlike subscription-based cloud services, it operates directly on your Windows or Mac hard drive, ensuring privacy while automatically renaming files based on key details like date, vendor, and amount for chronological sorting. The tool generates a comprehensive Excel spreadsheet containing all extracted data, making tax preparation, expense tracking, and audits effortless. With a transparent pay-per-use model costing approximately 50 cents per 100 receipts through OpenAI, ScanRelief offers long-term value without recurring subscription fees or vendor lock-in.

The Librarian

TheLibrarian.io is an AI-powered executive assistant designed to help users manage emails, scheduling, and information retrieval so they can focus on more meaningful work. The platform simplifies daily administrative load by organizing inboxes, drafting email responses, finding relevant information quickly, and coordinating schedules efficiently. It acts as a personal operations layer for professionals who want to reduce time spent on repetitive tasks. TheLibrarian.io frees users from manual searching, inbox clutter, and scheduling complexity, allowing them to redirect attention toward high-value priorities.

The Librarian

TheLibrarian.io is an AI-powered executive assistant designed to help users manage emails, scheduling, and information retrieval so they can focus on more meaningful work. The platform simplifies daily administrative load by organizing inboxes, drafting email responses, finding relevant information quickly, and coordinating schedules efficiently. It acts as a personal operations layer for professionals who want to reduce time spent on repetitive tasks. TheLibrarian.io frees users from manual searching, inbox clutter, and scheduling complexity, allowing them to redirect attention toward high-value priorities.

The Librarian

TheLibrarian.io is an AI-powered executive assistant designed to help users manage emails, scheduling, and information retrieval so they can focus on more meaningful work. The platform simplifies daily administrative load by organizing inboxes, drafting email responses, finding relevant information quickly, and coordinating schedules efficiently. It acts as a personal operations layer for professionals who want to reduce time spent on repetitive tasks. TheLibrarian.io frees users from manual searching, inbox clutter, and scheduling complexity, allowing them to redirect attention toward high-value priorities.

Pecunio AI

Pecunio AI is a finance-focused AI platform that connects directly to your existing toolslike Xero, Stripe, and QuickBooks so you can ask financial questions in plain English and get instant, CFO-level insights. Instead of wrestling with spreadsheets or waiting days for reports, you plug in via secure OAuth, benefit from bank-level encryption, and let purpose-built AI that understands accounting principles handle the heavy lifting. It generates comprehensive reports in seconds, explains results clearly, and offers ranked recommendations so you always know what action to take next. With real-time forecasting, cash flow modeling, and 24/7 financial health monitoring with alerts, Pecunio AI keeps your business ahead of surprises.

Pecunio AI

Pecunio AI is a finance-focused AI platform that connects directly to your existing toolslike Xero, Stripe, and QuickBooks so you can ask financial questions in plain English and get instant, CFO-level insights. Instead of wrestling with spreadsheets or waiting days for reports, you plug in via secure OAuth, benefit from bank-level encryption, and let purpose-built AI that understands accounting principles handle the heavy lifting. It generates comprehensive reports in seconds, explains results clearly, and offers ranked recommendations so you always know what action to take next. With real-time forecasting, cash flow modeling, and 24/7 financial health monitoring with alerts, Pecunio AI keeps your business ahead of surprises.

Pecunio AI

Pecunio AI is a finance-focused AI platform that connects directly to your existing toolslike Xero, Stripe, and QuickBooks so you can ask financial questions in plain English and get instant, CFO-level insights. Instead of wrestling with spreadsheets or waiting days for reports, you plug in via secure OAuth, benefit from bank-level encryption, and let purpose-built AI that understands accounting principles handle the heavy lifting. It generates comprehensive reports in seconds, explains results clearly, and offers ranked recommendations so you always know what action to take next. With real-time forecasting, cash flow modeling, and 24/7 financial health monitoring with alerts, Pecunio AI keeps your business ahead of surprises.

Editorial Note

This page was researched and written by the ATB Editorial Team. Our team researches each AI tool by reviewing its official website, testing features, exploring real use cases, and considering user feedback. Every page is fact-checked and regularly updated to ensure the information stays accurate, neutral, and useful for our readers.

If you have any suggestions or questions, email us at hello@aitoolbook.ai