- Investment Bankers: Accelerate deal-making, pitch decks, and market research with AI-driven insights.

- Private Equity & Hedge Funds: Uncover investment opportunities and analyze market trends efficiently.

- Financial Analysts: Automate financial documentation, company profiling, and earnings call analysis.

- Portfolio Managers: Access real-time data and research to optimize asset allocation and strategy.

- Financial Researchers & Journalists: Extract relevant financial information from extensive datasets quickly.

How to Use Rogo?

- Sign Up and Integrate Data: Connect your firm’s internal documents and external data sources securely.

- Customize AI Models: Tailor workflows and AI agents to meet specific financial research and reporting needs.

- Generate Insights & Reports: Use AI to scan, analyze, and synthesize financial data into actionable outputs.

- Collaborate & Automate: Share AI-generated materials across teams and automate routine workflows for efficiency.

- Finance-Specific AI Models: Deep understanding of financial terminology and workflows for precise results.

- Seamless Data Integration: Connects with internal systems, filings, transcripts, and real-time market data.

- Auditability & Transparency: Provides inline citations and verifiable sources for all outputs.

- Robust Security & Compliance: Enterprise-grade data protection meeting SOC2, GDPR, and other standards.

- Workflow Automation: Automates repetitive tasks like meeting prep, document summarization, and slide creation.

- Purpose-built AI for financial sector workflows.

- Highly secure with strong data privacy protocols.

- Boosts productivity by automating detailed financial research.

- Clear and auditable insights with inline citations.

- Complex setup and customization may require onboarding support.

- Not suited for industries outside finance.

- Premium pricing tailored to enterprise clients.

- May require some learning curve for non-technical users.

Custom

Pricing information is not directly provided.

Proud of the love you're getting? Show off your AI Toolbook reviews—then invite more fans to share the love and build your credibility.

Add an AI Toolbook badge to your site—an easy way to drive followers, showcase updates, and collect reviews. It's like a mini 24/7 billboard for your AI.

Reviews

Rating Distribution

Average score

Popular Mention

FAQs

Similar AI Tools

Orchestration AI

Orchestration AI is a platform for building intelligent AI agents that automate business workflows. It allows users to create and manage AI-powered agents—such as marketing assistants, support bots, or account handlers—with capabilities to integrate with email, CRMs, databases, and more via email and webhooks. It supports creating multilayered agents with built-in logic for security, compliance, and behavior orchestration.

Orchestration AI

Orchestration AI is a platform for building intelligent AI agents that automate business workflows. It allows users to create and manage AI-powered agents—such as marketing assistants, support bots, or account handlers—with capabilities to integrate with email, CRMs, databases, and more via email and webhooks. It supports creating multilayered agents with built-in logic for security, compliance, and behavior orchestration.

Orchestration AI

Orchestration AI is a platform for building intelligent AI agents that automate business workflows. It allows users to create and manage AI-powered agents—such as marketing assistants, support bots, or account handlers—with capabilities to integrate with email, CRMs, databases, and more via email and webhooks. It supports creating multilayered agents with built-in logic for security, compliance, and behavior orchestration.

HeronAI

HeronAI is an AI-powered analytics platform designed to simplify financial reporting and transform raw data into actionable insights. It enables businesses to generate real-time dashboards and reports in minutes, eliminating the need for manual data analysis and empowering teams to make informed decisions swiftly.

HeronAI

HeronAI is an AI-powered analytics platform designed to simplify financial reporting and transform raw data into actionable insights. It enables businesses to generate real-time dashboards and reports in minutes, eliminating the need for manual data analysis and empowering teams to make informed decisions swiftly.

HeronAI

HeronAI is an AI-powered analytics platform designed to simplify financial reporting and transform raw data into actionable insights. It enables businesses to generate real-time dashboards and reports in minutes, eliminating the need for manual data analysis and empowering teams to make informed decisions swiftly.

Genloop AI

Genloop is a platform that empowers enterprises to build, deploy, and manage custom, private large language models (LLMs) tailored to their business data and requirements — all with minimal development effort. It turns enterprise data into intelligent, conversational insights, allowing users to ask business questions in natural language and receive actionable analysis instantly. The platform enables organizations to confidently manage their data-driven decision-making by offering advanced fine-tuning, automation, and deployment tools. Businesses can transform their existing datasets into private AI assistants that deliver accurate insights, while maintaining complete security and compliance. Genloop’s focus is on bridging the gap between AI and enterprise data operations, providing a scalable, trustworthy, and adaptive solution for teams that want to leverage AI without extensive coding or infrastructure complexity.

Genloop AI

Genloop is a platform that empowers enterprises to build, deploy, and manage custom, private large language models (LLMs) tailored to their business data and requirements — all with minimal development effort. It turns enterprise data into intelligent, conversational insights, allowing users to ask business questions in natural language and receive actionable analysis instantly. The platform enables organizations to confidently manage their data-driven decision-making by offering advanced fine-tuning, automation, and deployment tools. Businesses can transform their existing datasets into private AI assistants that deliver accurate insights, while maintaining complete security and compliance. Genloop’s focus is on bridging the gap between AI and enterprise data operations, providing a scalable, trustworthy, and adaptive solution for teams that want to leverage AI without extensive coding or infrastructure complexity.

Genloop AI

Genloop is a platform that empowers enterprises to build, deploy, and manage custom, private large language models (LLMs) tailored to their business data and requirements — all with minimal development effort. It turns enterprise data into intelligent, conversational insights, allowing users to ask business questions in natural language and receive actionable analysis instantly. The platform enables organizations to confidently manage their data-driven decision-making by offering advanced fine-tuning, automation, and deployment tools. Businesses can transform their existing datasets into private AI assistants that deliver accurate insights, while maintaining complete security and compliance. Genloop’s focus is on bridging the gap between AI and enterprise data operations, providing a scalable, trustworthy, and adaptive solution for teams that want to leverage AI without extensive coding or infrastructure complexity.

RiskInMind

RiskInMind is an AI-powered risk management platform designed specifically for modern financial institutions. It streamlines and enhances risk assessment, compliance, and operational efficiency by leveraging advanced AI agents. The tool assists with loan assessments by analyzing applicant data for potential risks, performs deep financial analysis for faster decision making, and ensures adherence to regulatory compliance. RiskInMind also automates document generation, reducing administrative workload and errors. Overall, it offers a comprehensive solution for managing financial and operational risks, helping institutions make accurate, data-driven decisions while maintaining compliance with evolving regulations.

RiskInMind

RiskInMind is an AI-powered risk management platform designed specifically for modern financial institutions. It streamlines and enhances risk assessment, compliance, and operational efficiency by leveraging advanced AI agents. The tool assists with loan assessments by analyzing applicant data for potential risks, performs deep financial analysis for faster decision making, and ensures adherence to regulatory compliance. RiskInMind also automates document generation, reducing administrative workload and errors. Overall, it offers a comprehensive solution for managing financial and operational risks, helping institutions make accurate, data-driven decisions while maintaining compliance with evolving regulations.

RiskInMind

RiskInMind is an AI-powered risk management platform designed specifically for modern financial institutions. It streamlines and enhances risk assessment, compliance, and operational efficiency by leveraging advanced AI agents. The tool assists with loan assessments by analyzing applicant data for potential risks, performs deep financial analysis for faster decision making, and ensures adherence to regulatory compliance. RiskInMind also automates document generation, reducing administrative workload and errors. Overall, it offers a comprehensive solution for managing financial and operational risks, helping institutions make accurate, data-driven decisions while maintaining compliance with evolving regulations.

Vise

Vise is an integrated, AI-driven platform designed to help financial advisors and wealth management firms deliver personalized investment portfolios at scale. By automating critical tasks like tax-loss harvesting and rebalancing, Vise enables firms to efficiently manage client accounts and create customized portfolios tailored to both firm strategies and individual client goals. The platform addresses challenges of fragmented technology, supporting robust analytic tools for proposals and account transitions. Through seamless integration with custodians and flexible investment strategies, Vise strives to improve investment outcomes and empower advisors to focus on client relationships and business growth.

Vise

Vise is an integrated, AI-driven platform designed to help financial advisors and wealth management firms deliver personalized investment portfolios at scale. By automating critical tasks like tax-loss harvesting and rebalancing, Vise enables firms to efficiently manage client accounts and create customized portfolios tailored to both firm strategies and individual client goals. The platform addresses challenges of fragmented technology, supporting robust analytic tools for proposals and account transitions. Through seamless integration with custodians and flexible investment strategies, Vise strives to improve investment outcomes and empower advisors to focus on client relationships and business growth.

Vise

Vise is an integrated, AI-driven platform designed to help financial advisors and wealth management firms deliver personalized investment portfolios at scale. By automating critical tasks like tax-loss harvesting and rebalancing, Vise enables firms to efficiently manage client accounts and create customized portfolios tailored to both firm strategies and individual client goals. The platform addresses challenges of fragmented technology, supporting robust analytic tools for proposals and account transitions. Through seamless integration with custodians and flexible investment strategies, Vise strives to improve investment outcomes and empower advisors to focus on client relationships and business growth.

Nanonets

Nanonets is an AI-powered platform designed to break down data barriers by extracting valuable information from documents, emails, tickets, and databases. It transforms unstructured data from multiple sources into actionable insights, helping teams automate complex manual workflows with a no-code interface. Nanonets uses learnable decision engines, equipping organizations to make faster and more informed decisions. The solution delivers measurable ROI in weeks, with accuracy exceeding 95%, and helps reduce processing times by about 50%. Its integrations, like direct SAP connectivity, enhance business processes such as accounts payable, while robust compliance with standards like GDPR, SOC 2, and HIPAA protects sensitive data.

Nanonets

Nanonets is an AI-powered platform designed to break down data barriers by extracting valuable information from documents, emails, tickets, and databases. It transforms unstructured data from multiple sources into actionable insights, helping teams automate complex manual workflows with a no-code interface. Nanonets uses learnable decision engines, equipping organizations to make faster and more informed decisions. The solution delivers measurable ROI in weeks, with accuracy exceeding 95%, and helps reduce processing times by about 50%. Its integrations, like direct SAP connectivity, enhance business processes such as accounts payable, while robust compliance with standards like GDPR, SOC 2, and HIPAA protects sensitive data.

Nanonets

Nanonets is an AI-powered platform designed to break down data barriers by extracting valuable information from documents, emails, tickets, and databases. It transforms unstructured data from multiple sources into actionable insights, helping teams automate complex manual workflows with a no-code interface. Nanonets uses learnable decision engines, equipping organizations to make faster and more informed decisions. The solution delivers measurable ROI in weeks, with accuracy exceeding 95%, and helps reduce processing times by about 50%. Its integrations, like direct SAP connectivity, enhance business processes such as accounts payable, while robust compliance with standards like GDPR, SOC 2, and HIPAA protects sensitive data.

Quantexa

Quantexa is a Decision Intelligence platform that fuses data, analytics, and trusted AI to help organizations make smarter, faster, and more trusted decisions. Its core features include scalable data ingestion, dynamic entity resolution, contextual graph analytics, and agentic AI designed for explainable outputs across industries like finance, insurance, healthcare, government, and telecom. Quantexa unifies billions of data points from internal and external sources, providing holistic customer views, automating routine workflows, and enabling proactive fraud detection, risk management, and personalized engagement. With capabilities like NLP pipelines and predictive modeling, the platform enhances operational performance, offering over 90% more accuracy and dramatically faster analytical resolution compared to traditional methods.

Quantexa

Quantexa is a Decision Intelligence platform that fuses data, analytics, and trusted AI to help organizations make smarter, faster, and more trusted decisions. Its core features include scalable data ingestion, dynamic entity resolution, contextual graph analytics, and agentic AI designed for explainable outputs across industries like finance, insurance, healthcare, government, and telecom. Quantexa unifies billions of data points from internal and external sources, providing holistic customer views, automating routine workflows, and enabling proactive fraud detection, risk management, and personalized engagement. With capabilities like NLP pipelines and predictive modeling, the platform enhances operational performance, offering over 90% more accuracy and dramatically faster analytical resolution compared to traditional methods.

Quantexa

Quantexa is a Decision Intelligence platform that fuses data, analytics, and trusted AI to help organizations make smarter, faster, and more trusted decisions. Its core features include scalable data ingestion, dynamic entity resolution, contextual graph analytics, and agentic AI designed for explainable outputs across industries like finance, insurance, healthcare, government, and telecom. Quantexa unifies billions of data points from internal and external sources, providing holistic customer views, automating routine workflows, and enabling proactive fraud detection, risk management, and personalized engagement. With capabilities like NLP pipelines and predictive modeling, the platform enhances operational performance, offering over 90% more accuracy and dramatically faster analytical resolution compared to traditional methods.

Rillet

Rillet is an AI-native ERP platform designed to streamline complex financial and accounting workflows for modern businesses. It automates revenue recognition (including ASC 606 compliance), invoicing, payment tracking, multi-entity accounting, and financial close management. With integrated AI-powered reconciliation, real-time cash flow insights, and advanced reporting capabilities, Rillet provides a unified source of financial truth for diverse industries such as professional services, financial services, e-commerce, healthcare, and non-profits. The platform’s native AI co-pilot interacts with your financial data conversationally, enabling teams to self-serve insights and focus on decision-making while routine processes like bank reconciliation and transaction coding run automatically.

Rillet

Rillet is an AI-native ERP platform designed to streamline complex financial and accounting workflows for modern businesses. It automates revenue recognition (including ASC 606 compliance), invoicing, payment tracking, multi-entity accounting, and financial close management. With integrated AI-powered reconciliation, real-time cash flow insights, and advanced reporting capabilities, Rillet provides a unified source of financial truth for diverse industries such as professional services, financial services, e-commerce, healthcare, and non-profits. The platform’s native AI co-pilot interacts with your financial data conversationally, enabling teams to self-serve insights and focus on decision-making while routine processes like bank reconciliation and transaction coding run automatically.

Rillet

Rillet is an AI-native ERP platform designed to streamline complex financial and accounting workflows for modern businesses. It automates revenue recognition (including ASC 606 compliance), invoicing, payment tracking, multi-entity accounting, and financial close management. With integrated AI-powered reconciliation, real-time cash flow insights, and advanced reporting capabilities, Rillet provides a unified source of financial truth for diverse industries such as professional services, financial services, e-commerce, healthcare, and non-profits. The platform’s native AI co-pilot interacts with your financial data conversationally, enabling teams to self-serve insights and focus on decision-making while routine processes like bank reconciliation and transaction coding run automatically.

Alkymi

Alkymi is an AI-powered data automation platform designed specifically for financial services and private markets. It transforms unstructured investment and financial documents, such as capital calls, quarterly reports, financial statements, and offering memorandums, into structured, actionable datasets. The platform uses advanced AI, machine learning, and large language models (LLMs) to automate complex data workflows, enabling firms to unlock and manage 100% of their investment data efficiently. Alkymi’s end-to-end solution integrates with downstream systems, providing real-time portfolio data, accelerating operational workflows, and empowering clients to make faster, data-driven investment decisions. It is tailored to meet the needs of private market firms and helps scale operations with greater accuracy and speed.

Alkymi

Alkymi is an AI-powered data automation platform designed specifically for financial services and private markets. It transforms unstructured investment and financial documents, such as capital calls, quarterly reports, financial statements, and offering memorandums, into structured, actionable datasets. The platform uses advanced AI, machine learning, and large language models (LLMs) to automate complex data workflows, enabling firms to unlock and manage 100% of their investment data efficiently. Alkymi’s end-to-end solution integrates with downstream systems, providing real-time portfolio data, accelerating operational workflows, and empowering clients to make faster, data-driven investment decisions. It is tailored to meet the needs of private market firms and helps scale operations with greater accuracy and speed.

Alkymi

Alkymi is an AI-powered data automation platform designed specifically for financial services and private markets. It transforms unstructured investment and financial documents, such as capital calls, quarterly reports, financial statements, and offering memorandums, into structured, actionable datasets. The platform uses advanced AI, machine learning, and large language models (LLMs) to automate complex data workflows, enabling firms to unlock and manage 100% of their investment data efficiently. Alkymi’s end-to-end solution integrates with downstream systems, providing real-time portfolio data, accelerating operational workflows, and empowering clients to make faster, data-driven investment decisions. It is tailored to meet the needs of private market firms and helps scale operations with greater accuracy and speed.

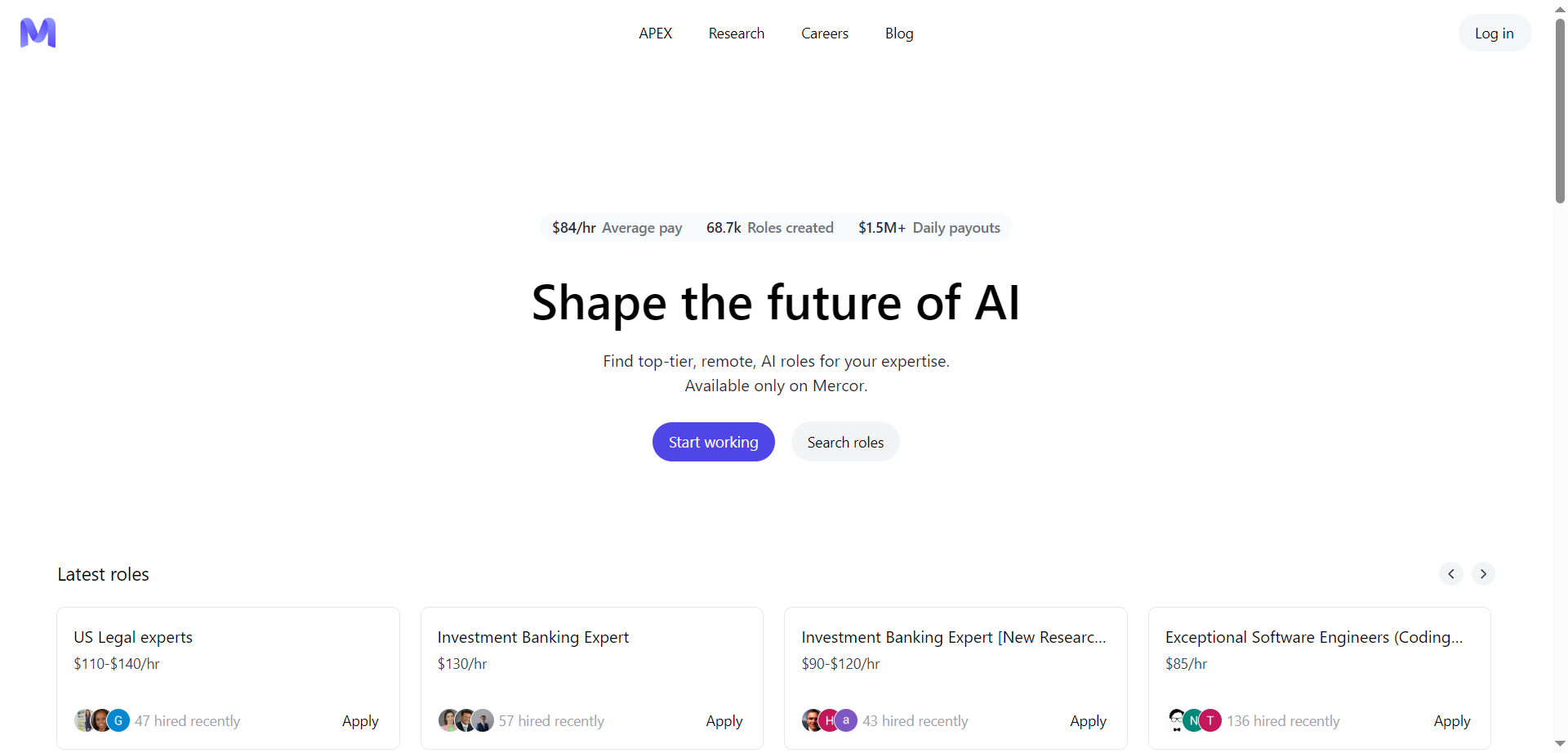

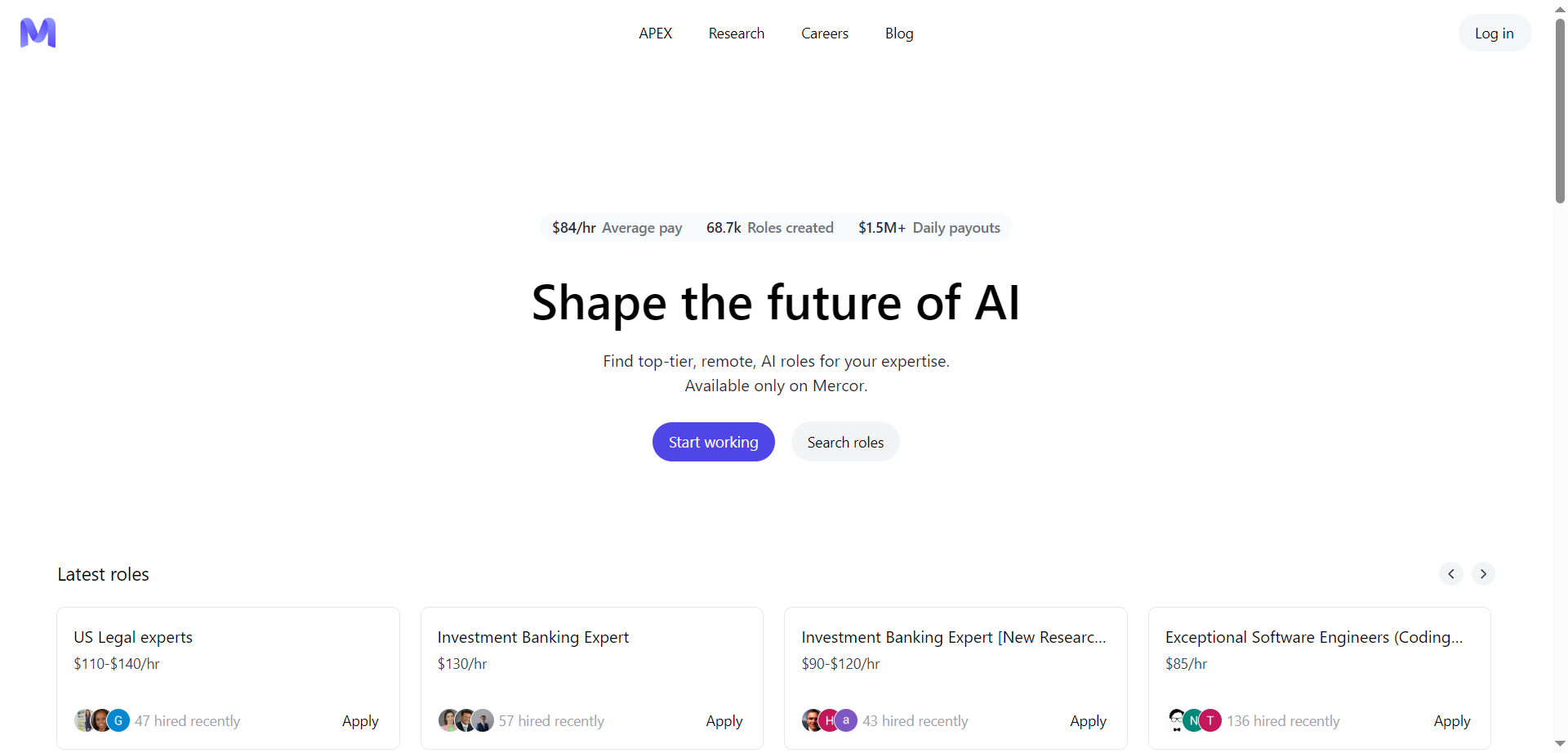

Mercor

Mercor is a specialized platform connecting top-tier remote experts with AI-related projects and roles across various domains such as legal, investment banking, management consulting, software engineering, and academic research. It offers a curated marketplace where professionals with deep expertise can find freelance and contract opportunities with competitive pay and daily payouts. Mercor supports AI-driven productivity by matching skilled talent to complex projects, facilitating research collaborations, and advancing innovation across industries like finance, law, software, and medical research. The platform emphasizes high-quality talent acquisition to accelerate AI development and application worldwide.

Mercor

Mercor is a specialized platform connecting top-tier remote experts with AI-related projects and roles across various domains such as legal, investment banking, management consulting, software engineering, and academic research. It offers a curated marketplace where professionals with deep expertise can find freelance and contract opportunities with competitive pay and daily payouts. Mercor supports AI-driven productivity by matching skilled talent to complex projects, facilitating research collaborations, and advancing innovation across industries like finance, law, software, and medical research. The platform emphasizes high-quality talent acquisition to accelerate AI development and application worldwide.

Mercor

Mercor is a specialized platform connecting top-tier remote experts with AI-related projects and roles across various domains such as legal, investment banking, management consulting, software engineering, and academic research. It offers a curated marketplace where professionals with deep expertise can find freelance and contract opportunities with competitive pay and daily payouts. Mercor supports AI-driven productivity by matching skilled talent to complex projects, facilitating research collaborations, and advancing innovation across industries like finance, law, software, and medical research. The platform emphasizes high-quality talent acquisition to accelerate AI development and application worldwide.

Fazeshift

Fazeshift is an AI-powered platform deploying specialized agents for accounts receivable automation, integrating seamlessly with existing ERP, CRM, billing, and payment systems like Stripe, NetSuite, Sage Intacct, and SAP. It handles cash application for complex matching scenarios, automated collections with smart reminders, AI contract review comparing terms to billing, billing agent turning contracts into invoices, payment portal for self-serve customer access, credit agent pulling reports and setting limits, payment dispute tracking, and onboarding agent syncing forms to ERPs. The security-first solution eliminates over 90% of manual tasks, unlocks daily productivity hours, accelerates cash flow, provides AI insights, and ensures unified visibility with SOC 2 Type II compliance, GDPR adherence, SSO, and zero-data retention.

Fazeshift

Fazeshift is an AI-powered platform deploying specialized agents for accounts receivable automation, integrating seamlessly with existing ERP, CRM, billing, and payment systems like Stripe, NetSuite, Sage Intacct, and SAP. It handles cash application for complex matching scenarios, automated collections with smart reminders, AI contract review comparing terms to billing, billing agent turning contracts into invoices, payment portal for self-serve customer access, credit agent pulling reports and setting limits, payment dispute tracking, and onboarding agent syncing forms to ERPs. The security-first solution eliminates over 90% of manual tasks, unlocks daily productivity hours, accelerates cash flow, provides AI insights, and ensures unified visibility with SOC 2 Type II compliance, GDPR adherence, SSO, and zero-data retention.

Fazeshift

Fazeshift is an AI-powered platform deploying specialized agents for accounts receivable automation, integrating seamlessly with existing ERP, CRM, billing, and payment systems like Stripe, NetSuite, Sage Intacct, and SAP. It handles cash application for complex matching scenarios, automated collections with smart reminders, AI contract review comparing terms to billing, billing agent turning contracts into invoices, payment portal for self-serve customer access, credit agent pulling reports and setting limits, payment dispute tracking, and onboarding agent syncing forms to ERPs. The security-first solution eliminates over 90% of manual tasks, unlocks daily productivity hours, accelerates cash flow, provides AI insights, and ensures unified visibility with SOC 2 Type II compliance, GDPR adherence, SSO, and zero-data retention.

Informly

Informly is an AI-powered market research platform that generates customized reports in minutes by answering a few questions about your business needs. It pulls real-time data from web sources like industry databases, government stats, and news to deliver insights on market trends, competitors, consumers, risks, and economics at low cost. Designed for quick, informed decisions, it uses live web search and AI for fast, reliable intelligence without traditional research delays.

Informly

Informly is an AI-powered market research platform that generates customized reports in minutes by answering a few questions about your business needs. It pulls real-time data from web sources like industry databases, government stats, and news to deliver insights on market trends, competitors, consumers, risks, and economics at low cost. Designed for quick, informed decisions, it uses live web search and AI for fast, reliable intelligence without traditional research delays.

Informly

Informly is an AI-powered market research platform that generates customized reports in minutes by answering a few questions about your business needs. It pulls real-time data from web sources like industry databases, government stats, and news to deliver insights on market trends, competitors, consumers, risks, and economics at low cost. Designed for quick, informed decisions, it uses live web search and AI for fast, reliable intelligence without traditional research delays.

Editorial Note

This page was researched and written by the ATB Editorial Team. Our team researches each AI tool by reviewing its official website, testing features, exploring real use cases, and considering user feedback. Every page is fact-checked and regularly updated to ensure the information stays accurate, neutral, and useful for our readers.

If you have any suggestions or questions, email us at hello@aitoolbook.ai